How To Cure A Financial Hangover

There are times throughout the year when we may find that our money is stretched further than normal, and it can be difficult to manage. If we don’t budget and prepare for this correctly, we may be faced with extra bills to pay in the form of debt. This is often described as a financial hangover – but don’t worry, there are ways that we can get our finances to a better position. If you are faced with an emergency and you don’t have the funds to pay for it, payday loans UK can help you with an unprecedented expense. Read on to find out more about how to cure your financial hangover.

What do we mean by a financial hangover?

A financial hangover may take place when we have spent too much in a short period. This typically happens over Christmas when our finances have to stretch further to accommodate a packed social calendar and gifts for the people in our lives. Sometimes, we can get carried away with the excitement and end up spending more than we should, and more than we can afford. It can also lead to us spending on credit cards in an attempt to manage our overspending, which can leave us wondering how we’re going to pay for these things when the New Year comes around. This is a common occurrence for many of us, but there are ways that you can avoid getting yourself into a difficult financial decision. Read on to find out more.

What causes a financial hangover?

There are a few factors that can cause a financial hangover. For example, if you are heading into the Christmas period with no budget or plan on how much you are going to spend – this will lead to you spending more than you can afford. Choosing to use credit cards in a bid to manage your finances may seem like a good idea at the time, but you must remember that you’ll have to pay for it later! If you do not have a handle on managing your finances during this busy and expensive time, you will end up with a financial hangover.

How can you fix your finances?

So, you’ve been hasty with your money towards the end of the year, and your finances are looking a little worse for wear – how can you reduce the impact of this financial hangover on your bank account, and manage it so that it doesn’t get any worse? Here are a few ways that you can reduce the damage:

Assess

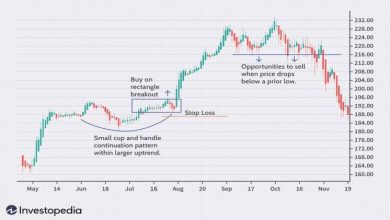

Before you can start putting a plan in place to get your finances back on top, you’re going to need to take the time to assess your past spending. If you have been making reckless purchases without checking your account, you may not know what you have to work with – so this is the best place to start. Check your credit card statements to get an idea of how much you owe, and how much you’ll need to pay off in the coming months, this can help you with the next couple of steps.

Prioritise

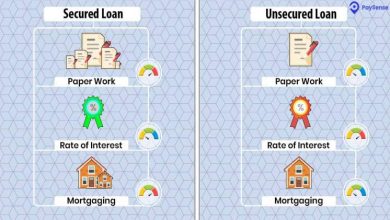

Make a list of primary payments for the month and prioritise. Mortgage or rent payments will be at the top of the list, along with car payments, energy bills and other payments you must pay to live. You will then see how much you have left to pay your debts so you can tackle them and get rid of them for good. It is essential that you pay as much of your credit card debts off as possible so that your credit score does not deplete, and land you in a difficult financial situation.

Create and stick to your budget

After a heavy month of spending, it’s important that you get back to your budget so you can build up your finances and overcome your hangover. Of course, the first thing that you need to do is prioritise your repayments, but once you have done that, you can see how much you will have left to work with for the rest of the month – this is what you will have to use for secondary expenses. You should include savings in your budget so that you can remain consistent and get a head start on building your finances back up.

Cut unnecessary spending

If you’re experiencing a financial hangover, you’ll benefit from cutting any unnecessary spending. The only way to get your finances back into shape is to take care of them in a way that boosts your bank account. You can do this by taking the time to cancel any subscriptions that you don’t use – like streaming services you may have forgotten about. Now would also be the perfect time to cancel that gym membership you never use! Make lists when you’re shopping and give yourself an amount that you are allowed to spend in line with your budget. Make sure that you stick to this limit, as this will help to regulate impulse purchases. This will allow you to rebuild your finances in time for the new year so you can start fresh.