Things to Keep in Mind When Submitting Bike Loan Documents

Obtaining a bike loan can be an exciting step towards owning the two-wheeler of your dreams. However, the process begins with submitting the necessary bike loan documents. Preparing beforehand and submitting these documents is essential to ensure a smooth and successful loan application. In this comprehensive guide, we will explore the dos and don’ts of submitting bike loan documents to help you secure your loan with the best possible bike loan interest rate.

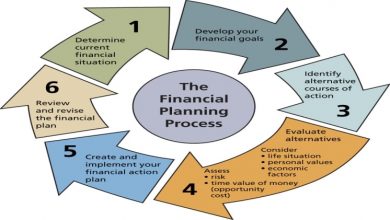

- Plan Ahead:

Before you even think about submitting your bike loan documents, take some time to plan and organise. Create a checklist of all the documents you’ll need, including identity and address proof, income statements, and vehicle-related documents. This proactive approach can save you time and prevent last-minute hassles.

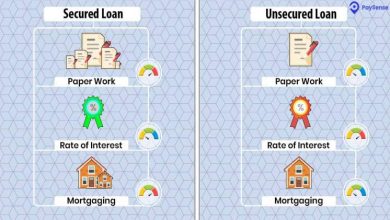

- Check the Lender’s Requirements:

Different lenders may have varying document requirements. Make sure you are aware of the specific documents your chosen lender needs. This knowledge will help you gather the right paperwork and avoid unnecessary delays.

- Verify Document Authenticity:

Ensure that all your documents are up-to-date and authentic. Any outdated or fraudulent documents can lead to the rejection of your loan application. This step is crucial for your loan application’s approval and to avoid legal complications.

- Keep Copies of Everything:

Always make copies of the documents you submit for your bike loan. Having copies of the documents on hand can be helpful in case you need to refer to them during the loan application process or if you misplace the originals.

- Provide All Necessary Income Documents:

Lenders will assess your repayment capacity when reviewing your loan application. To demonstrate your ability to repay the loan, include income-related documents such as salary slips, income tax returns, or bank statements. The more comprehensive your financial documents, the better your chances of securing favourable loan terms like a low bike loan interest rate.

- Be Truthful and Accurate:

Honesty is paramount when submitting your bike loan documents. Provide accurate information, and don’t attempt to manipulate any details. Misrepresentation can not only result in a rejected loan but may also lead to legal consequences.

- Cross-check Your Application:

Review your loan application and documents carefully before submission. Ensure that all the information is accurate and consistent across all documents. Any discrepancies can raise red flags and delay the approval process.

- Seek Professional Advice if Needed:

If you’re unsure about any aspect of your bike loan documents or need guidance, don’t hesitate to seek professional assistance. A financial advisor or loan specialist can provide valuable insights and ensure that your application is in top shape.

- Follow Up on Your Application:

After submitting your bike loan documents, follow up with the lender to ensure they have received everything and that your application is in progress. Being proactive can help resolve any issues or questions quickly, potentially speeding up the approval process.

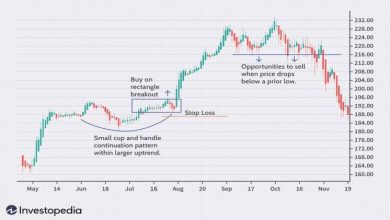

- Keep an Eye on Your Credit Score:

Regularly monitor your credit score. A good credit score can make a significant difference in the bike loan interest rate and other loan terms you are offered. If your score is lower than desired, work on improving it before applying for the loan.

- Don’t Rush the Process:

Rushing through the document submission process can lead to mistakes or missing documents. Take your time to ensure everything is in order before applying for the loan.

- Avoid Delay in Submission:

While rushing is not advisable, delaying the submission of your bike loan documents can also be problematic. Lenders often have specific processing times, and waiting too long could lead to unnecessary delays in approval.

- Don’t Make Multiple Applications Simultaneously:

Applying for a bike loan with multiple lenders simultaneously can negatively impact your credit score and create confusion for lenders. It’s better to research and select one lender that aligns with your needs before applying.

- Read the Fine Print Carefully:

When applying for a bike loan, it’s essential to read and understand the terms and conditions. Ignoring the fine print can lead to surprise expenses down the road. These include additional charges you failed to consider and even penalties. Make sure you note down the terms mentioned in the loan agreement and evaluate them carefully prior to signing the contract.

- Don’t Hesitate to Ask Questions:

If you have any doubts or questions about the application process or the required documents, don’t hesitate to ask the lender for clarification. It’s better to seek clarification and ensure you have all the necessary information to proceed.

Conclusion

In conclusion, submitting bike loan documents is a critical step in securing your two-wheeler loan. By following the dos and avoiding the don’ts, you can streamline the application process, enhance your chances of approval, and ultimately ride off into the sunset on your new bike.