How Loans Become Unsecure

Whether you run a business, or you need help managing your money, a loan can be beneficial to many of us. You can choose a lender and loan that is perfectly suited to your circumstances so that you can boost your finances when you need it most, whether you’re growing your business, or buying a house. There are many different types of loans that you can choose from depending on your requirements, like a small business loan, a merchant cash advance or an equipment loan which are perfect for businesses that need a boost to improve profits and achieve their goals. Read on as we take a look at unsecured and secured loans.

Advantages of taking out a loan

Whilst you should think carefully about whether you really need a loan and whether you can afford the repayments, some clear advantages come with deciding to apply for a loan when you really need it. You can benefit from one lump sum of cash that you can use to help you – whether that’s with your personal or business finances, to buy a house for example, or to grow your business. You can benefit from flexibility depending on the type of lender that you choose, which can offer you various amounts to suit your needs. Even if you have bad credit and have struggled to make loan repayments in the past, there are finance options to suit you. We’ll look at a few loans that you could choose from below.

Types of loans

If you’ve decided that you’re going to apply for a loan to pay for an expense or an unprecedented emergency, it is always best to know more about the types of loans you can choose to suit you and your business. Some of the most popular loans are:

- Small business loans: These loans are perfect for businesses that need help to get started, to finance hiring and training staff, or to buy equipment. You can choose from a range of loans to suit your business needs.

- Equipment financing: This type of loan is great for businesses that cannot function without expensive equipment. For example, farms and construction workers need specialist machinery to keep their businesses functioning and make money. Buying this equipment is difficult and puts a strain on cash flow unless businesses have a lump sum of savings to pay for it. You can benefit from the equipment you need and pay for it monthly with this type of finance.

- Merchant cash advances: This type of finance allows you access to a lump sum of money that you will pay back with a percentage of your credit and debit card payments. Although this type of loan may end up costing you more than others, it is a quick way of freeing up cash flow and it is technically not the same as other types of debt.

- Invoice financing: We all know how late payments from customers and clients can impact our business’s cash flow. You can use invoice financing to get the sum of your invoices from a lender, which you will pay back when you receive the payment from your client.

Unsecured loans

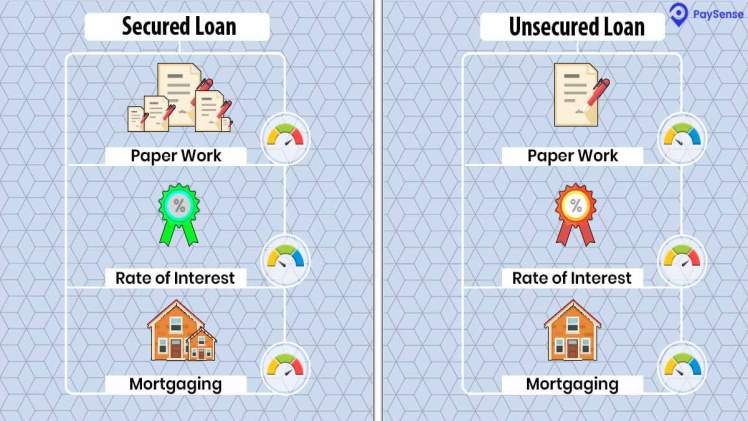

So, what is an unsecured loan? When applying for an unsecured loan from your lender, you will not have to provide collateral. This means that you do not have to provide your lender with anything that they can take from you as a guarantee that you will make your repayments. When applying for an unsecured loan, you borrow money from a lender and enter into an agreement with them that says you will repay the amount with additional interest. Because there is no collateral, interest rates may be higher, and lenders will consider your credit score when deciding how trustworthy you are when it comes to making payments.

Secured loans

In contrast to unsecured loans, these types of loans do require collateral. Some of the most common types of secured loans are mortgages, and car finance, as they can both be taken from you if you cannot afford your agreed repayments. Interest rates on a secured loan tend to be less because the lender has an asset that they can use for security. Although these loans are easier to be approved for and offer lower interest rates, unless it is a mortgage or a car finance loan, you should be wary when it comes to secured loans as you may run the risk of losing whichever asset it is that you use as collateral.

Which is best?

Comparing the two can give you an idea of which is best so that you can make the right decision for your finances. Generally, unsecured loans are straightforward, all you have to do is approach your lender and apply for a loan. You may incur more interest depending on your credit score and report, but if you think you will be able to afford the repayments, it is generally less risky for you as a borrower. It is worth noting that you may incur fees if you struggle to pay your bills and your credit score will suffer.

When it comes to secured loans, they can look more appealing to those of us that struggle when it comes to approval for traditional loans. Although they carry less interest, you need to weigh up whether you can really afford them, because failure to pay could have a detrimental impact on your life, as your assets can be taken away from you.