Insurer Can’t Reject Your Claim If You Meet This Criteria

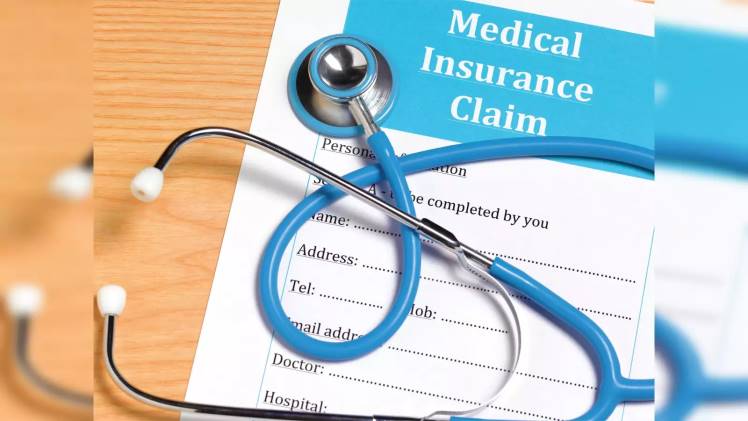

In today’s fast-paced world, insurance protects individuals and businesses from risks and uncertainties. Whether health insurance, auto insurance, or home insurance, policyholders rely on insurers to provide financial support when unforeseen events occur. However, there have been instances where insurers reject valid claims, leaving policyholders frustrated and financially burdened. To address this concern, specific criteria have been put in place to protect the rights of policyholders. This article explores a bar that insurers cannot ignore when evaluating claims, ensuring fair treatment and peace of mind for those who meet it.

Health insurance companies cannot deny your claims if you have had continuous coverage for at least eight years. The IRDAI recently released guidelines for the standardisation of exclusions, which include this provision and several others. These standards will apply to products submitted after October 1, 2019. The new regulations will take effect for health contracts on October 1, 2020. The health policy would be unchallengeable except for proven fraud or any permanent exclusions. This will lessen policyholder complaints.

Additionally, insurers won’t be able to outright refuse coverage to people with serious illnesses or conditions like cancer, heart problems, Alzheimer’s, Parkinson’s, HIV/AIDS, and others. The list includes 16 different types of diseases. People with these conditions were not previously regarded as being eligible for health insurance. For instance, those who had, let’s say, epilepsy in the past were unable to obtain health insurance for unrelated conditions. With permanent exclusions for the current diseases, they can now. Cancer patients who were diagnosed many years ago experienced a situation similar to this. Thanks to the change, more people will now fall within the scope of coverage. The rules provide a great deal of clarity. For example, all health insurance claims not relating to chronic kidney diseases will be covered once the insurer decides to include policyholders in the portfolio. A doctor identified pre-existing conditions (PED) within 48 months of the policy’s issuance.

Additionally, insurance companies must pay for the specified modern treatment methods, such as deep brain stimulation, oral chemotherapy, immunotherapy, etc. The guidelines have made policies more inclusive by mandating the inclusion of current procedures.

The premiums could increase as a result of these changes, though. From the perspective of a policyholder, most changes are favourable. But paying for contemporary medical procedures comes at a price. And once the new framework is in place, this might show up in premiums.

The availability of insurance coverage is a comforting assurance for individuals and businesses facing potential risks. It provides a safety net, offering financial protection and the benefits of health insurance when the unexpected happens. However, the improper rejection of claims by insurers has been a source of frustration for policyholders. To rectify this issue, regulations have been implemented to ensure that insurers cannot reject claims if specific criteria are met. By adhering to these criteria, insurers are held accountable, and policyholders are guaranteed a fair assessment of their claims.

Standard T&C Apply. # Visit the official website of IRDAI for further details.

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.